Explainer: Our New Paper Exploring the Implications of Private Equity Acquisitions in Fertility Industry for Patients

By Joseph Bruch and Alex Borsa

Over the past few years, the GenderSci Lab has begun examining the intersections of gender and health care finance. Feminist STS scholars have long examined how financial arrangements influence the production and understanding of science; such arrangements also directly influence how and to whom health care is delivered. Our work explores the terrain of the financialization of OB/GYN and fertility care as well as the growing arena of investor-financed “Femtech” companies.

Private equity in women’s health

Image Credit: “White and Purple Pregnancy Test Kit” by cottonbro on Pexels.com

Private equity firms are financial institutions that acquire companies and then within a couple of years sell the companies for a sizeable profit. As part of the acquisition, private equity firms typically load debt onto the company and siphon its profits in the form of dividends to shareholders. While proponents of private equity argue that steep profit incentives are good for industry, there is increasing concern that the business model may conflict with the goals of health care delivery.

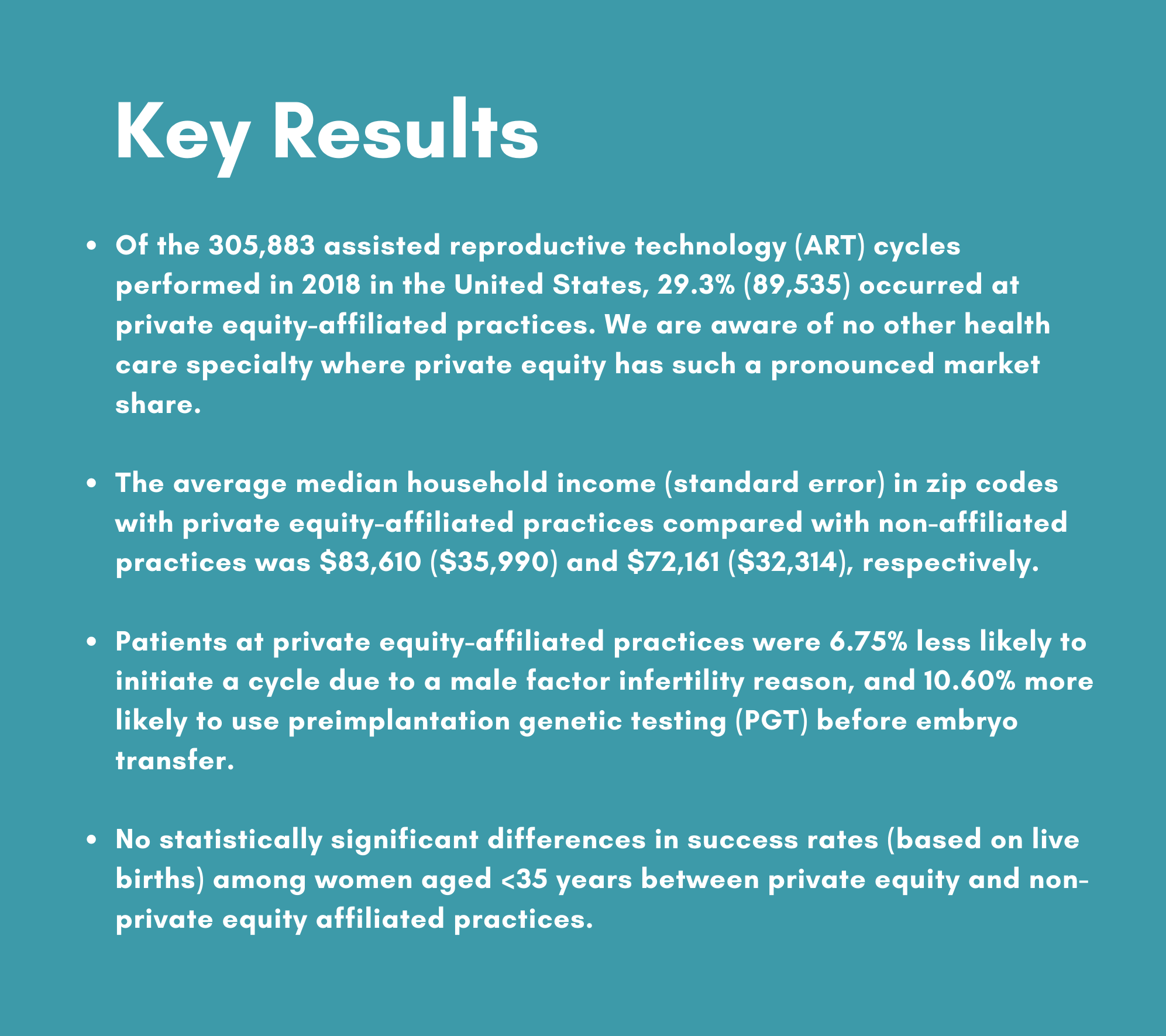

In earlier work published in JAMA Internal Medicine, we showed that private equity firms have been rapidly buying up and consolidating OB/GYN, fertility, and women’s health practices since 2017. Next, we wanted to better understand the impacts of these developments on health care delivery, accessibility, and service utilization. Our first results appeared last month in a new study in the journal Fertility and Sterility, which showed that private equity has substantial influence in the fertility industry and that private equity-affiliated practices tend to be in wealthier geographic areas and provide different services, including increased rates of preimplantation genetic testing, than non-private equity-affiliated practices. We found no differences in implantation success rates.

What we did and what we found

Our new study evaluated the prevalence and performance of private equity-owned fertility clinics in the United States. To begin, we looked at the CDC’s 2018 Fertility Clinic Success Rates Report, which is an annual public health surveillance dataset reporting a variety of key metrics on all the fertility practices in the U.S. After a rigorous search to identify which of the practices were owned by private equity, we found the following:

The significance of these findings

The GenderSci Lab’s Health Care Finance team documents and examines the influence that financial institutions and practices have on the health of women and gender minorities. We are particularly interested in examining what financialized and commodified health products mean for health systems and gendered and sexed bodies.

This study is the first to quantify the extent to which private equity is acquiring swaths of the fertility industry. As reproductive health care increasingly becomes a target of financial investment, research characterizing the magnitude of private equity in this sector and its implications for reproductive health is necessary. For example, our finding of greater use of preimplantation genetic testing among patients at private equity-affiliated clinics raises interesting questions about service use and whether private equity-affiliated practices push elective and costly add-ons.

Our finding that private equity-affiliated practices tend to be located in wealthier areas provokes important considerations surrounding who has access to fertility services and the financial constraints associated with these services. Because of limited insurance coverage for fertility services, many patients pay out of pocket and may go into debt to finance these treatments, which can be capitalized on by fertility investors. Moreover, the cost of fertility services has inspired the rise of specialized third-party fertility lenders, whose referral arrangements with fertility practices have raised legal concerns about the ethics of fertility service provision, accessibility, and financing. The sociologist Lucy van de Wiel has framed this tight coupling between third-party fertility lenders and fertility practices as part of a larger “speculative turn” in the industry, wherein patient-consumer populations and the services marketed to them are increasingly centered on managing possible future infertility throughout the life course.

What’s next?

As we continue to study the influence of private equity investors on the fertility industry, we will investigate how private equity firms team up with third-party financial lenders. We want to evaluate whether these new financial arrangements inhibit or increase access to fertility services, which are important to achieving reproductive justice.

Authors’ analysis of private equity services and success metrics, as described in Borsa and Bruch (2021).

How to cite this blog post

Bruch, J. and Borsa, A. “Explainer: Our New Paper Exploring the Implications of Private Equity Acquisitions in Fertility Industry for Patients.” GenderSci Blog, October 25, 2021. genderscilab.org/blog/private-equity-acquisitions-in-fertility-industry

Statement of Intellectual Labor:

Joseph Dov Bruch and Alex Borsa wrote and edited the blog post. Heather Shattuck-Heidorn, Kelsey Ichikawa, and Sarah Richardson provided edits.